Presented at International Fastener Expo 2021

In early 2020 as COVID swept across the globe, supply chains began to reel as the consequences of the pandemic forced actions such as factory shutdowns and workforce shortages. The resulting leadtime increase led to a jump in order quantities to account for the extended time between receipt of shipments, but between March and May of 2020 there was a massive plummet in demand. All of a sudden businesses had more inventory than they had had in the recent past and half the demand, leading to a tremendous jump in ‘Days on Hand’.

Fortunately, this March to May stretch did not last and demand recovered quickly and continues to climb. The only issue is leadtimes have not recovered like demand, in fact, they have continued to decline. This has led to the opposite problem experienced in March through May as businesses now have declining ‘Days on Hand’ caused by rising demand and inability to get items on the shelf.

The above is obviously applying a broad brush to the current set of issues created by COVID, but is representative of the “general” inventory issues present for most businesses. Using some anonymized client data from Hydrian, it is possible to see how these effects have played out with a real business and lends itself to a discussion on how to mitigate the effects of the current state.

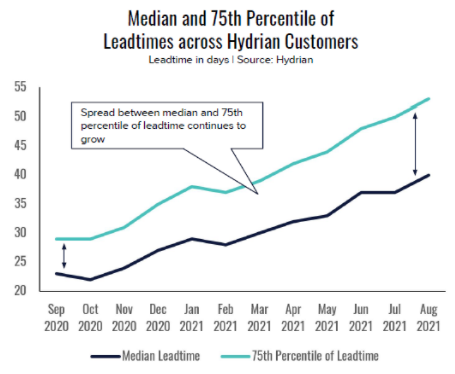

Pulled from actual client data, we can see in the graphic below that since September of 2020, lead times have not only risen but the spread between the median lead time and 75th percentile of leadtime has widened. This means that it takes longer to get what you ordered from your supplier AND the actual count of days you will receive it in is less predictable, culminating in increased inventory values.

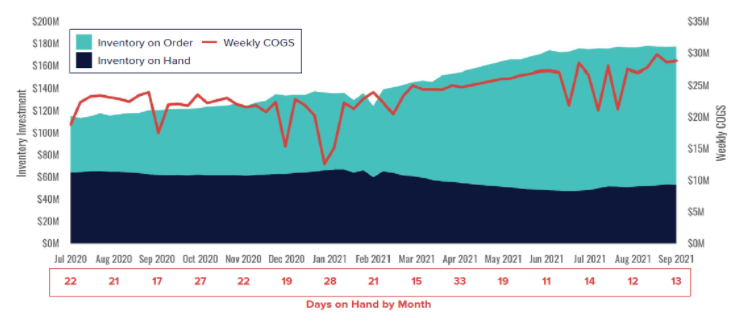

In the chart below, it is clear to see how leadtimes have affected inventory investment. Inventory on order has risen to account for increased demand (shown by the red line), longer leadtimes, and less predictable lead times. However, we also see inventory on hand declining which tells us that receipt of shipments cannot keep up with demand due to these leadtime delays.

With unprecedented ‘inventory on order’ levels, the potential for an “ocean” of excess stock is a real concern if supply chain challenges suddenly resolve themselves. However, what we know about COVID is its impacts are hard to predict, so being prepared to be nimble regardless of circumstances is the new requirement. Below are some strategies to minimize stockouts in the face of huge demand and supply uncertainty and ensure that when lead times do recover and customer demand returns to normal, inventory doesn't balloon in value due to a bullwhip effect.

1. Develop highly responsive inventory controls (e.g. min/max) and buying strategy

a. As lead times or demand grow, get more inventory “into the pipeline”

b. Conversely, be ready to reverse changes if demand falls or suppliers improve

2. Work with suppliers to adjust PO qtys, push / pull deliveries, and cancel if needed

a. Establish guidelines for “finalization” dates of PO qty, release date, etc

b. Share sales forecasts with suppliers (and ensure they utilize them)

3. Recognize unavoidable excess before it hits your shelf

a. If quantities can’t be changed / cancelled, start liquidating excess before it arrives

b. Consider price reduction, added marketing spend, or other promotion

c. When it makes sense, divert incoming POs to other facilities

4. Track appropriate metrics for measuring supplier and internal performance

a. Track both median / average as well as the distribution of lead times

b. Inventory turns / days on hand, in-stock rates, delivery speed, etc

A link to the full presentation can be found here.